Become a Certified Tax Professional

Training to prepare real returns, earn certification, and start accepting clients by tax season.

Earn industry-recognized certification

Hands-on return prep with pro-grade tools

Proven systems to onboard paying clients

Become a Certified Tax Professional

Enroll in Our Tax School Today!

Learn how to prepare taxes like a pro and start earning this tax season even with zero experience.

Our Tax School program is designed to help you gain the skills, confidence, and certification needed to start earning income by preparing taxes for clients. Whether you're looking for a new career, a side income, or to add tax preparation to your business this is for you.

What Clients Get

Three Signature Outcomes Our Students Achieve in Just 4 Weeks These Are the Exact Results That Make Tax School Worth the Investment:

Gain Real Tax Preparation Skills

Go from zero knowledge to confidently preparing tax returns using proven systems and tools.

Be Ready to Earn Income by Tax Season

Our students are equipped to start accepting paying clients quickly, turning skills into income.

Receive Certification & Professional Credibility

Secure the credentials you need to position yourself as a trusted tax professional in your community or business.

Why Our Tax School Works

Your Path to Tax Certification Starts Here

A practical 4‑week program that teaches you to prepare individual tax returns, earn certification, and begin accepting clients—no prior experience required.

Module 1 — Foundations & Compliance

Master filing statuses, income types, deductions, and credits. Learn the tax workflow and ethical standards used by professionals.

Module 2 — Hands‑On Return Prep

Prepare complete 1040 returns using realistic scenarios and pro‑grade software. Build speed, accuracy, and confidence.

Module 3 — Certification & Client Readiness

Sit for certification, set up your client process, and learn engagement, pricing, and retention best practices.

Student Success Stories

Real outcomes: certifications earned, clients onboarded, and income generated in the first season.

“I went from zero experience to filing returns for five paying clients by March. The step‑by‑step practice and instructor feedback made everything click.”

Maya — Certified Tax Preparer

“I passed certification on my first try and built a part‑time client roster within six weeks. The systems for pricing and onboarding were priceless.”

Sofia — Small Business Specialist

Ready to Become a Tax Professional?

Join the next cohort and learn the exact systems working in the field.

Choose Your Enrollment Option

Non‑CE is prioritized first for fastest start; CE enrollment is listed below.

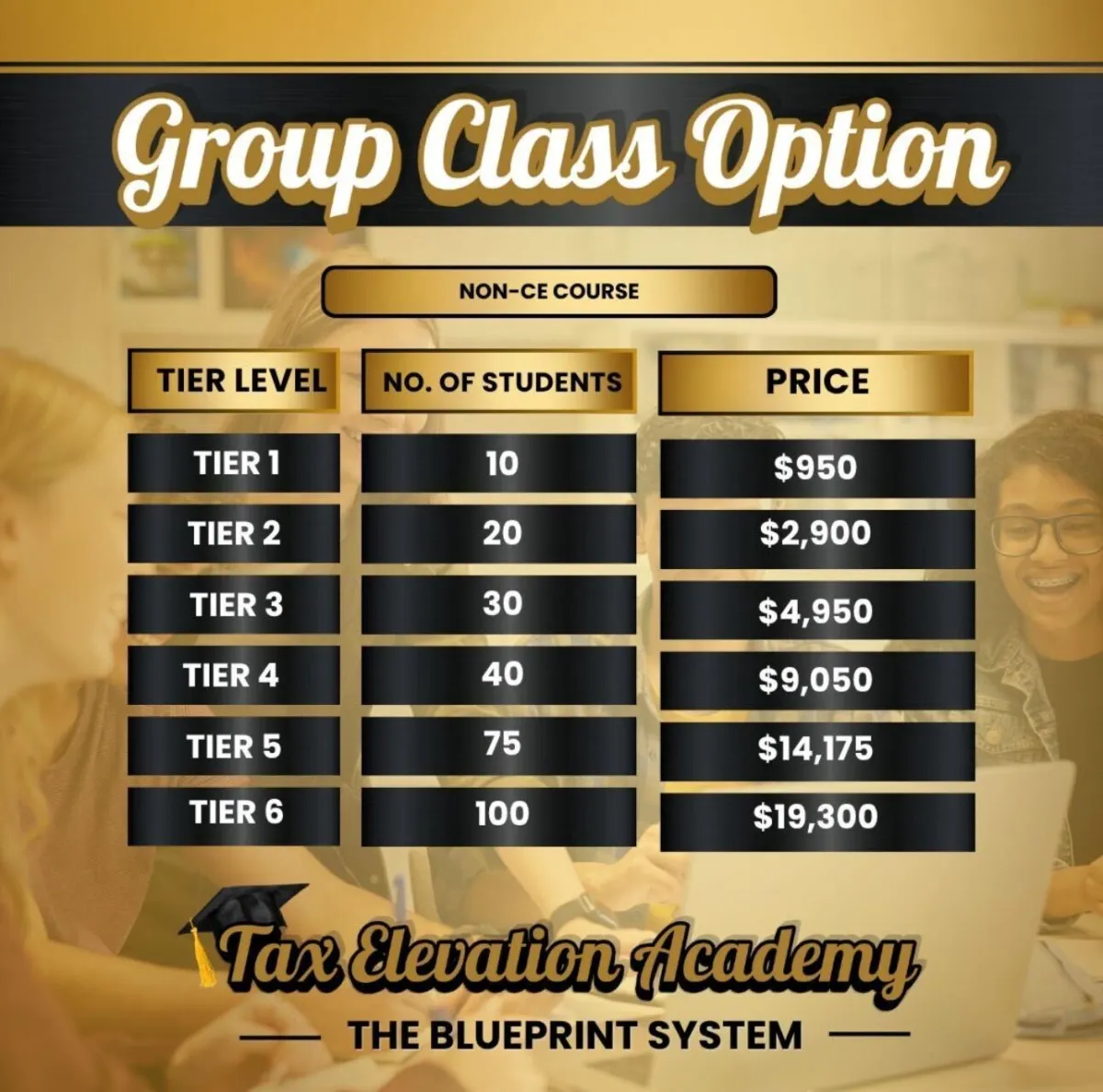

Non‑CE (Recommended)

Full curriculum without CE credits — ideal for skill building and practice.

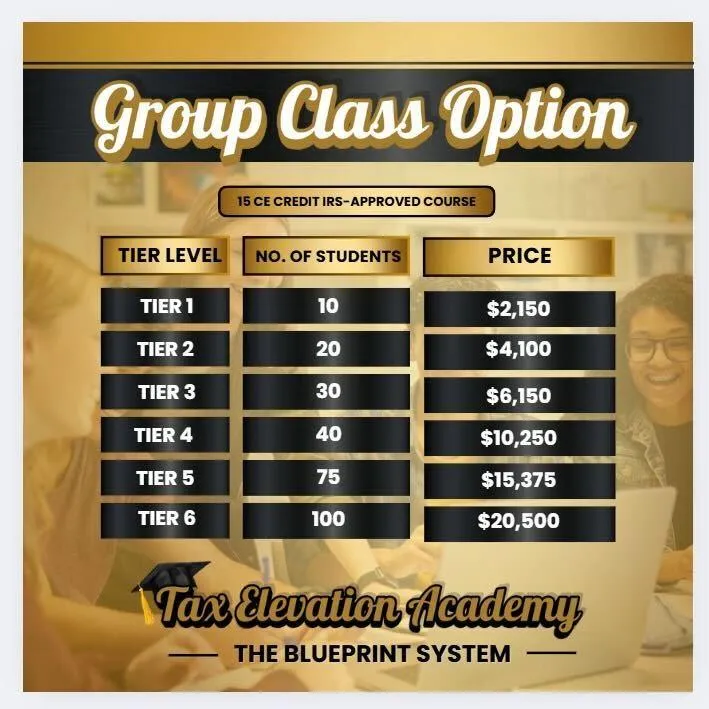

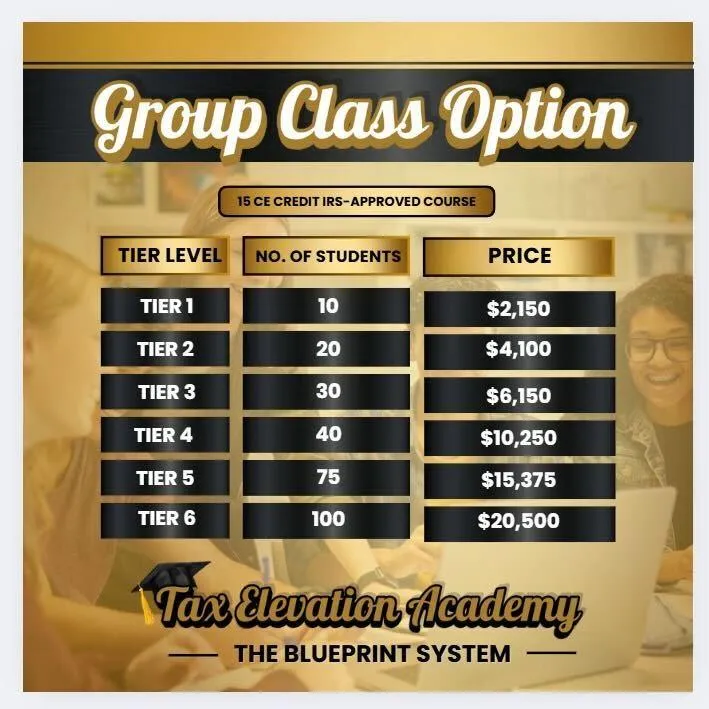

CE Credits

Includes industry‑recognized continuing education credits.

Choose Your Enrollment Option

CE Credits and Non‑CE — same elevated training, choose what fits your goals.

Non‑CE

Full curriculum without CE credits — perfect for skill building and practice.

- Complete 8‑week curriculum

- Certificate of completion

- Instructor support

CE Credits

Includes continuing education credits for licensed preparers.

- Industry‑recognized CE credits

- Certificate of completion

- Instructor support

Apply for Tax School

We open a limited number of complimentary admissions calls each month. Get your questions answered, confirm fit, and map your enrollment timeline.

This is a brief, practical session focused on your goals. If the program is right for you, we’ll outline next steps and start dates. If not, you’ll leave with clarity on the best path forward.

Limited availability for the upcoming cohort — average response time: 2 business days.